nanny tax calculator california

Astro a50 wont turn off red light. Countries to avoid when pregnant 2022.

Nanny Payroll Service Comparison Gtm Payroll Services And Homework Solutions

California minimum wage rate is 1400 per hour.

. Nanny tax calculator for household employers. Our easy-to-use budget calculator will help you estimate nanny taxes and identify potential tax breaks. As Canadas first and longest running payroll service dedicated to employers of domestic workers NannyTax manages nanny and caregiver payroll taxes and earnings for busy families across the country.

Your average tax rate is 1198 and your marginal tax rate is 22. We guarantee precision down to the last decimal point. Now that you see what it may cost to hire a nanny what your taxes may be and how much you can save with tax breaks take a look at what our nanny tax and payroll service can do for you.

The total cost of employment will be Gross Employers NI. Press the Calculate button to perform the calculation. Please use one of our two nanny tax calculators to determine the correct wages and withholdings for both hourly and salaried employees.

If you pay a household employee such as a nanny babysitter caregiver or house manager more than 2400 a year or 1000 in a quarter to perform work in your home or occasionally even out of your home such as in a nanny share you are a household employer. Please note the calculator may not be compatible with all devices please contact us with any questions. Nanny Tax Calculator California This rate will increase by 100 per hour each year until it reaches 15 per hour in 2023.

Our three service levels offer flexibility at affordable prices adjustable to your personal preferences and payroll requirements. Your average tax rate is 212and your marginal tax rate is 396. Household employees in California are covered by both the FLSA and California IWC Wage Order 15 and are non-exempt hourly employees paid at no less than the minimum wage.

Check out our Nanny Tax Calculator to give you an idea of how much it will be. When calculating taxes youll always pay a percentage of your nannys gross wages. Confederate states of america one dollar bill 1864 value.

If you make 70000 a year living in the region of California USA you will be taxed 15111. Hourly Calculator Calculate wages and payment for an employee who is paid by the hour. While the income taxes in California are high the property tax rates are.

Any employee pension payments will be deducted from the net pay you have supplied. Californias notoriously high top marginal tax rate of 133 which is the highest in the country only applies to income above 1 million for single filers and 2 million for joint filers. That means that your net pay will be 43324per year or 3610per month.

This is their pay before any withholdings or deductions. This is based on the 20222023 tax year using tax code 1257Lx and is relevant for the period up to and including 050722 this will be updated again after this point with the changes detailed in our tax rates and thresholds page. Were here to help.

It functions like a normal income tax and means that the top marginal rate in California is effectively 133. Nanny tax calculator for. Cost Calculator for Nanny Employers.

This calculator is intended to provide general payroll estimates only. This marginal tax rate means that. This rate will increase by 100 per hour each year until it reaches 15 per hour in 2023.

Technically tax brackets end at 123 and there is a 1 tax on personal income over 1 million. A nanny tax calculator will help you figure out whether the hourly rate youre offering your nanny will net out to a comfortable take-home wage. For specific tax advice and guidance please call us toll free at 877-626-6924 and a NannyChex payroll and tax expert will provide you with a free consultation.

If you make 55000a year living in the region of California USA you will be taxed 11676. This marginal tax rate means that your immediate additional income will be taxed at this rate. Its also helpful for you to see what tax savings you can get when paying a nanny legally which might help you feel more comfortable offering a higher hourly rate.

And if you need a sample nanny contract or access to nanny tax forms before your nanny begins working we have these free. If your nanny works 40 hours per week at 20hour then their gross pay is 800week. As part of the Mental Health Services Act this tax provides funding for mental health programs in the state.

The Best Online Payroll Services For 2022 Pcmag

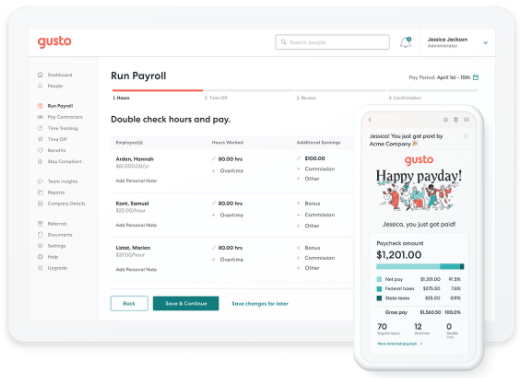

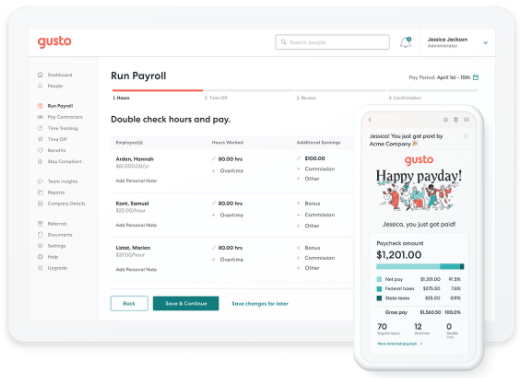

What Are Employer Taxes And Employee Taxes Gusto

The Benefits Of Legally Paying Your Nanny Nanny Lane

7 Steps To Doing Payroll Yourself Business Org

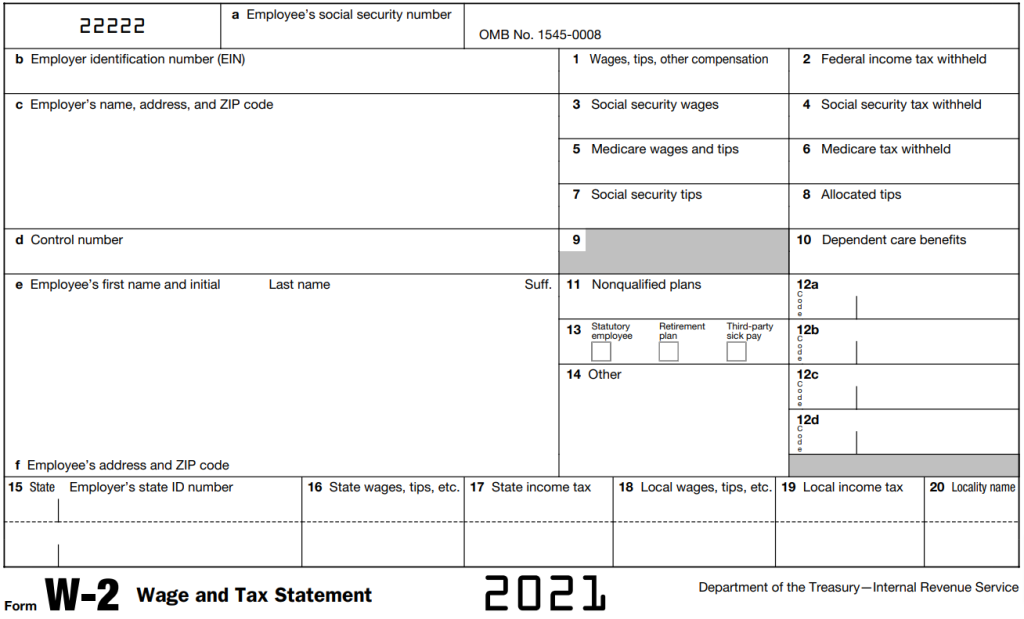

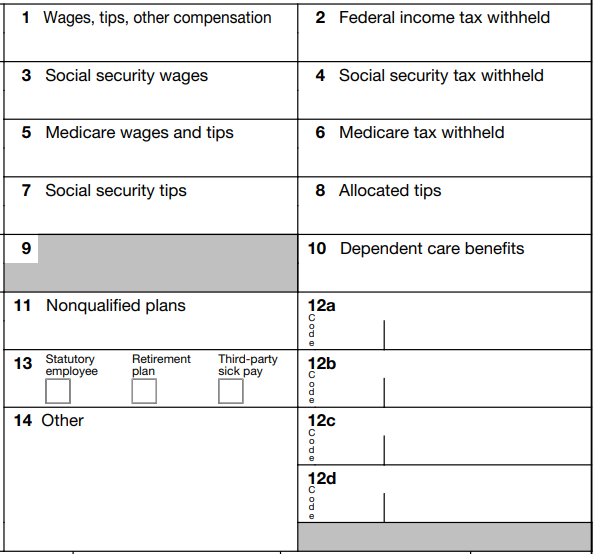

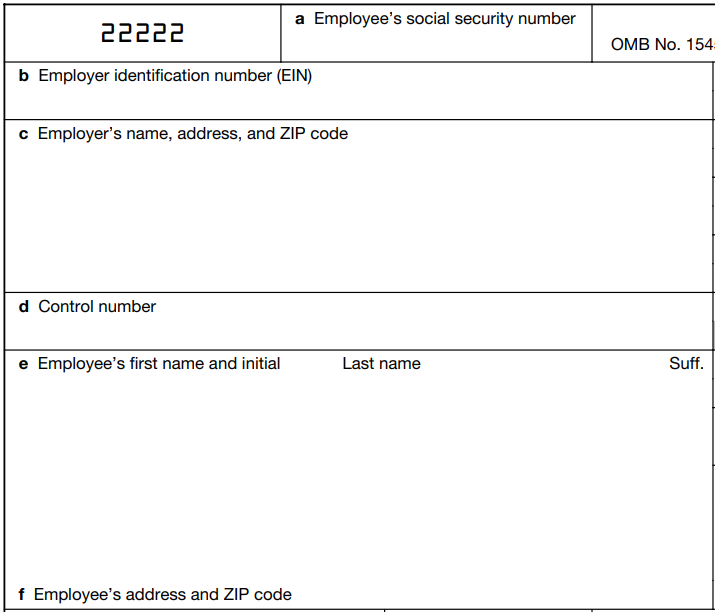

.png?width=290&name=W-2_(1).png)

Household Employment Blog Nanny Tax Information 1099 V W 2

Nanny Tax Procedures Every Family Should Know About Care Com Homepay

Parental Leave For Household Employees

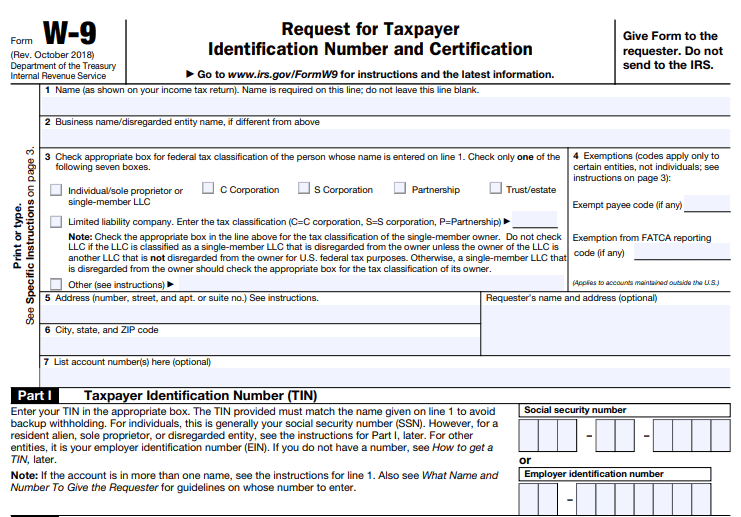

Contractor Payroll How To Pay Freelancers Contractors

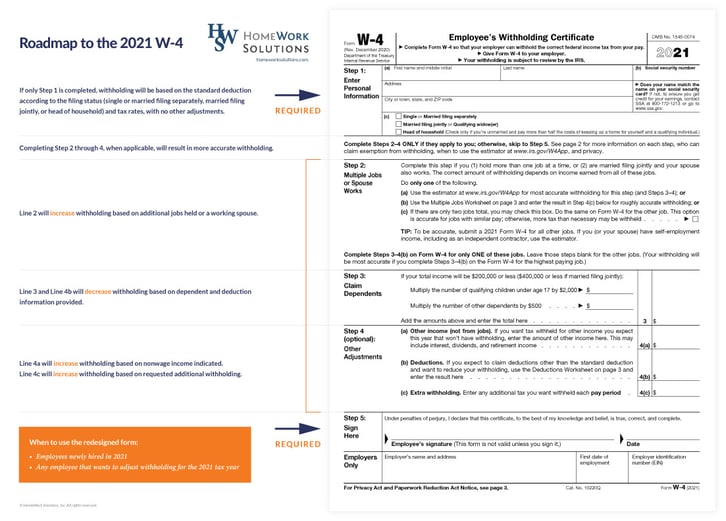

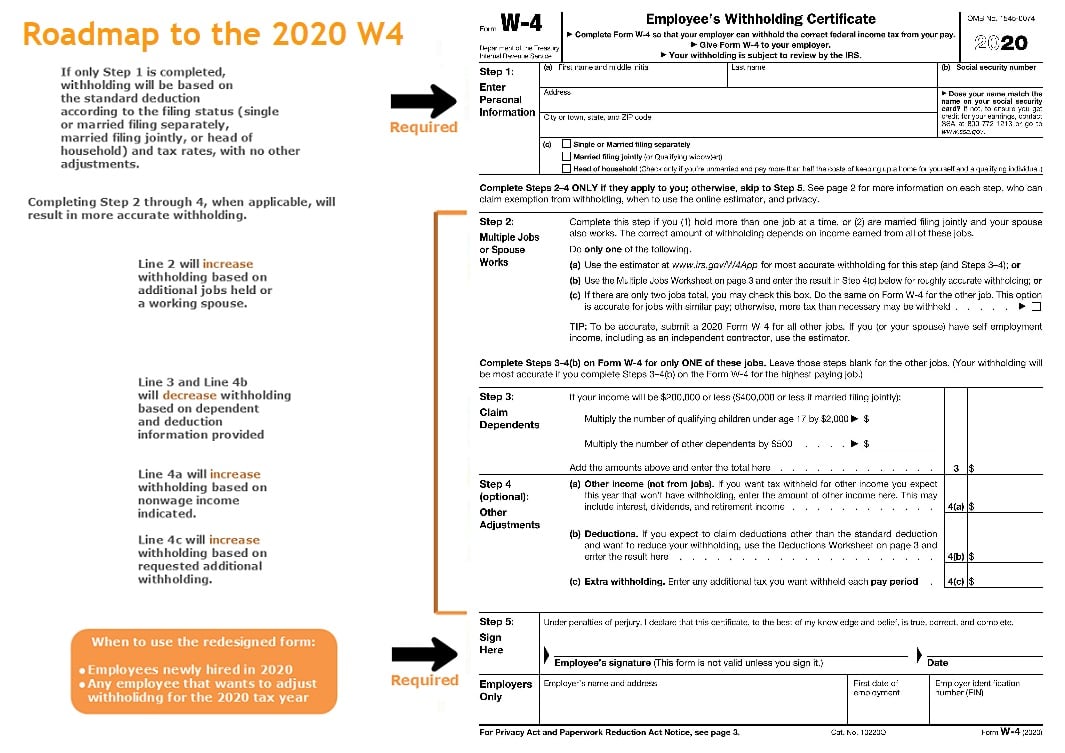

New W4 For 2021 What You Need To Know To Get It Done Right

New W4 For 2021 What You Need To Know To Get It Done Right

What Are Employer Taxes And Employee Taxes Gusto

The Best Online Payroll Services For 2022 Pcmag

Contractor Payroll How To Pay Freelancers Contractors